Real estate Investment is an important aspect of financial planning, and individuals often find themselves at a joint when thinking where to allot their hard earned money.

While there are various investment options available, real estate stands out as a physical and in history non failing choice. In this blog post, we will search into the question, “Is Real Estate the Best Investment?” by learning its pros and cons to help you make an informed decision.

Pros of Real Estate as Best Investment:

1. Tangible Asset:

One of the most notable advantages of real estate investment is the material of the asset. Unlike stocks or bonds, which are non material, real estate provides a physical presence. Investors can see, touch, and manage their assets, offering a sense of security and control.

2. Potential for Appreciation:

Real estate has a proven track record of rising over time. While there may be ups and downs in the market, property values generally increase, as long as share holder with potential long-term gains. This appreciation can result from factors such as financial growth, development in the area, or advances made to the property.

3. Rental Income:

Investing in real estate allows individuals to produce a steady stream of income through rental payments. This regular cash flow can help to covering debt payments, and property upkeep costs, and even provide extra income stream for share holders.

4. Diversification of Portfolio:

Diversifying one’s investment range is a key strategy for lesser risk. Real estate serves as an excellent diversification tool, as its performance is often independent of the stock market. During financial decline, real estate can act as a even out force for an overall investment range.

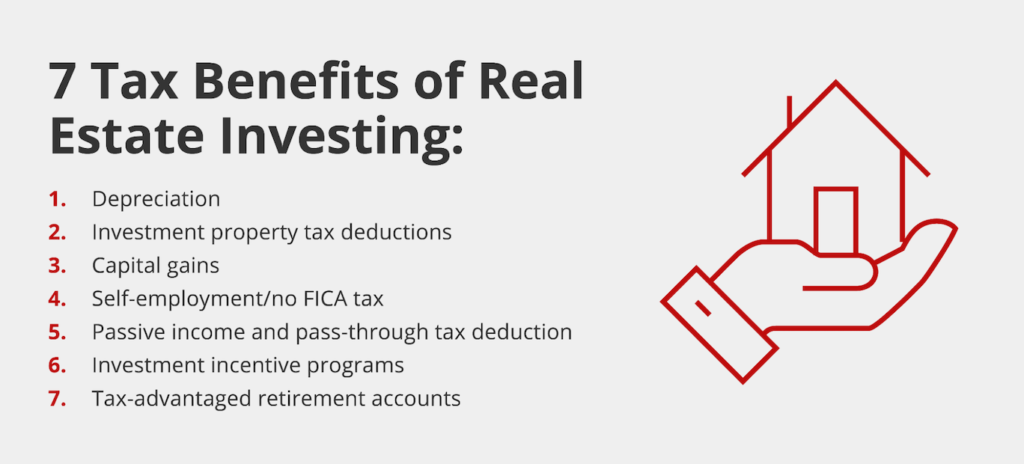

5. Tax Benefits:

Real estate investors can enjoy various tax advantages. Mortgage interest, property taxes, and certain expenses related to property management are often deductible. Additionally, capital gains from the sale of a primary residence may be eligible for tax exclusions.

Cons of Real Estate as Best Investment:

1. High Initial Costs:

One of the primary challenges of real estate investment is the large upfront costs. Purchasing property includes not only the buying price but also closing costs, property taxes, and possibly important re construction or upkeep cost.

2. Illiquidity:

Real estate is considered an non cash asset, meaning that changing it into cash may take time. Unlike stocks, which can be sold quickly on the market, selling a property can be a slow process, especially in a slow real estate market.

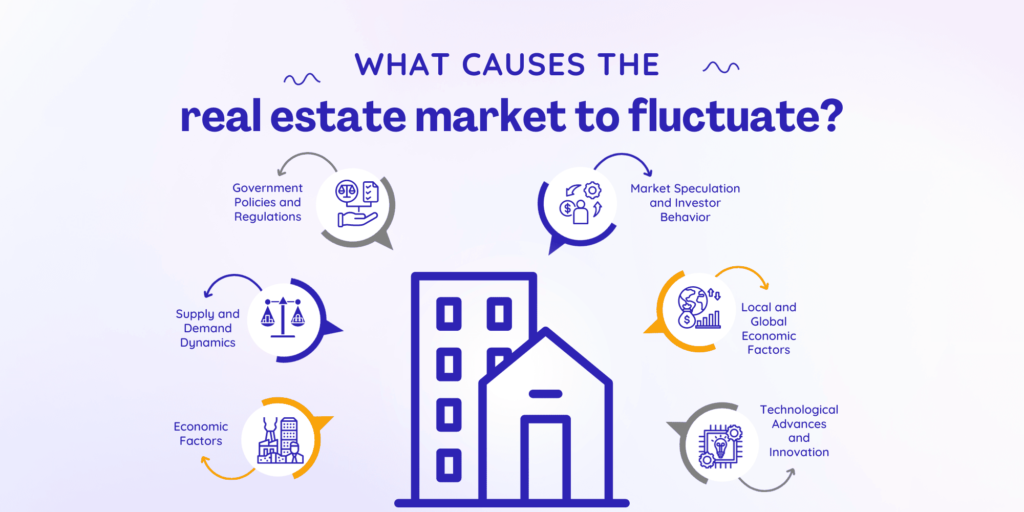

3. Market Fluctuations:

The real estate market tends to have financial differences and local differences. Economic dips can lead to a cut in property values, touching an investor’s potential for profit. Understanding the local market and financial trends is crucial for successful real estate investment.

4. Management Responsibilities:

Owning and handling real estate comes with various tasks, such as property upkeep, dealing with tenants, and speaking unexpected issues. Investors need to consider whether they have the time, resources, or feeling to handle these tasks or hire professional property management services.

Conclusion of Real Estate as Best Investment:

In conclusion, whether real estate is the best investment depends on individual financial goals, risk patience, and choices. Real estate offers physical benefits such as appreciation, rental income, and tax advantages, but it also comes with challenges like high initial costs, non cash, and market differences.

Before making any investment decisions, it is important to carefully research and analyze the local real estate market, understand personal financial goals, and seek professional advice if needed. Investors can make informed choices that align with their overall financial strategy and purposes. While real estate can be money-making, success often lies in careful planning, due concern, and a long-term perspective.(1)