The world of real estate is always changing, with ups and downs that affect the decisions of those looking to buy, sell, or invest. Understanding these patterns is crucial for making smart choices about when to make a move in the real estate market. In this detailed guide, we will delve into the different stages of real estate market cycles, what signs to watch out for in each stage, and how to navigate these cycles successfully.

Real Estate Market Cycles: An Overview

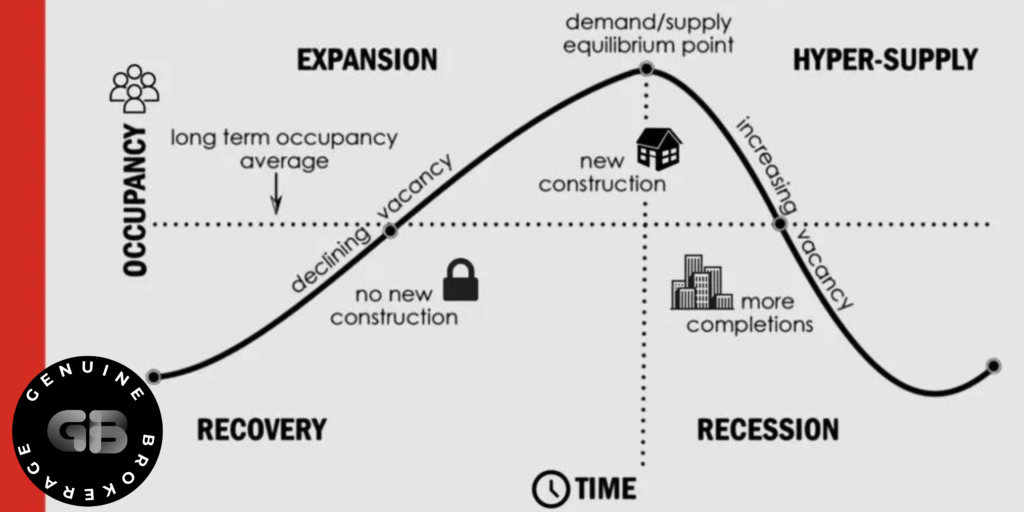

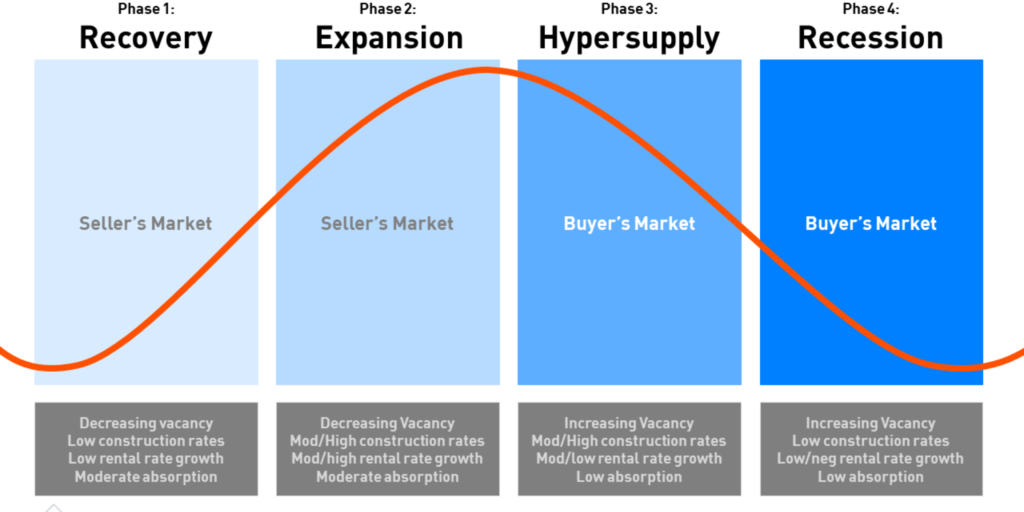

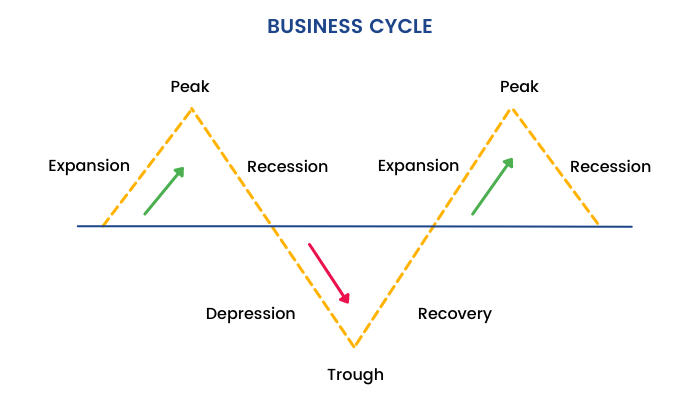

The real estate market goes through cycles that include times of growth, peak performance, decline, and bottoming out. Knowing about these cycles can help people predict what might happen next and make wise decisions that match the current economic climate. Here are the four main stages:

1. Recovery/Expansion:

- Characteristics: Rising demand, increasing home prices, growing job markets, and positive economic indicators.

- Key Indicators: Low-interest rates, high consumer confidence, and a decline in unemployment rates.

- Strategies: During this phase, buyers may find opportunities for value appreciation, making it an ideal time to invest. Sellers can benefit from rising property values.

2. Peak:

- Characteristics: Maximum price levels, increased speculative activities, and high levels of construction and development.

- Key Indicators: High property prices, excessive lending, and a surge in new construction.

- Strategies: Sellers may consider capitalizing on high property values, while cautious investors might start reassessing their portfolios.

3. Recession/Contraction:

- Characteristics: Declining home prices, rising unemployment, decreased consumer spending, and a slowdown in construction.

- Key Indicators: Increased foreclosure rates, reduced consumer confidence, and a decline in housing demand.

- Strategies: Buyers may find opportunities during a market downturn, and investors might explore distressed properties. Sellers may need to adjust expectations and hold off on selling if possible.

4. Trough:

- Characteristics: Lowest property values, increased foreclosures, and a lack of consumer confidence.

- Key Indicators: High levels of housing inventory, low transaction volumes, and economic uncertainty.

- Strategies: This phase presents opportunities for long-term investors to acquire properties at lower prices. Sellers might choose to hold off until the market stabilizes.

Key Indicators for Each Market Phase

1. Recovery/Expansion:

- Economic Indicators: Low-interest rates, GDP growth, increasing job creation.

- Real Estate Indicators: Rising home prices, high demand, low inventory levels.

2. Peak:

- Economic Indicators: Overheated job markets, excessive lending, inflationary pressures.

- Real Estate Indicators: Rapid home price increases, high levels of speculative buying.

3. Recession/Contraction:

- Economic Indicators: Rising unemployment, economic slowdown, declining GDP.

- Real Estate Indicators: Decreasing home prices, increased foreclosure rates, reduced consumer confidence.

4. Trough:

- Economic Indicators: Stabilizing or slightly improving economic conditions.

- Real Estate Indicators: Lowest property values, high housing inventory.

Strategies for Each Market Phase

1. Recovery/Expansion:

- Buyers: Consider entering the market for potential appreciation.

- Sellers: Take advantage of rising property values and sell strategically.

- Investors: Look for emerging opportunities and potential growth areas.

2. Peak:

- Buyers: Exercise caution and thoroughly assess potential risks.

- Sellers: Capitalize on high property values and consider selling to secure profits.

- Investors: Evaluate the market for signs of potential correction and reassess portfolios.

3. Recession/Contraction:

- Buyers: Explore distressed properties and negotiate favorable terms.

- Sellers: Be strategic, and if possible, hold off on selling until market conditions improve.

- Investors: Look for distressed assets, but conduct thorough due diligence.

4. Trough:

- Buyers: Identify undervalued properties for long-term investment.

- Sellers: Hold off on selling if possible until the market stabilizes.

- Investors: Consider acquiring assets at lower prices for future appreciation.

Navigating Market Cycles Successfully

1. Stay Informed:

Regularly monitor economic indicators, local market trends, and real estate news to stay informed about the current market conditions.

2. Diversify Your Portfolio:

Diversification helps mitigate risks associated with market fluctuations. Consider a mix of property types and geographic locations.

3. Adapt to Market Changes:

Be flexible and adapt your strategy based on the prevailing market conditions. What worked during a recovery phase may not be suitable during a contraction.

4. Consult with Professionals:

Seek advice from real estate professionals, financial advisors, and market analysts to make informed decisions aligned with your financial goals.

5. Long-Term Perspective:

Real estate is an inherently long-term investment. Approach market cycles with a focus on your long-term objectives, and avoid making impulsive decisions based on short-term fluctuations.

Case Studies: Real-Life Examples of Successful Market Navigation

1. Successful Timing in a Rising Market:

Explore a case where a buyer successfully entered the market during the recovery phase, benefiting from substantial appreciation over time.

2. Strategic Selling at the Peak:

Learn from a seller who strategically sold their property at the market peak, maximizing their returns before a downturn.

3. Value Investing During a Contraction:

Discover how an investor identified and capitalized on distressed properties during a recession, building a profitable portfolio.

4. Patient Holding During a Trough:

Explore a case where a property owner held off on selling during a trough, waiting for the market to stabilize and ultimately securing a favorable deal.

Conclusion: Mastering the Real Estate Market Cycles

Understanding real estate market cycles is a powerful tool for making informed decisions about when to buy, sell, or hold properties. By recognizing the key indicators and implementing strategies aligned with each market phase, stakeholders can navigate the dynamic real estate landscape successfully. Whether you’re a homeowner, investor, or aspiring buyer, leveraging this knowledge empowers you to make decisions that align with your financial goals and contribute to long-term real estate success. Embrace the cyclical nature of the market, stay informed, and position yourself to thrive in any phase of the real estate cycle.